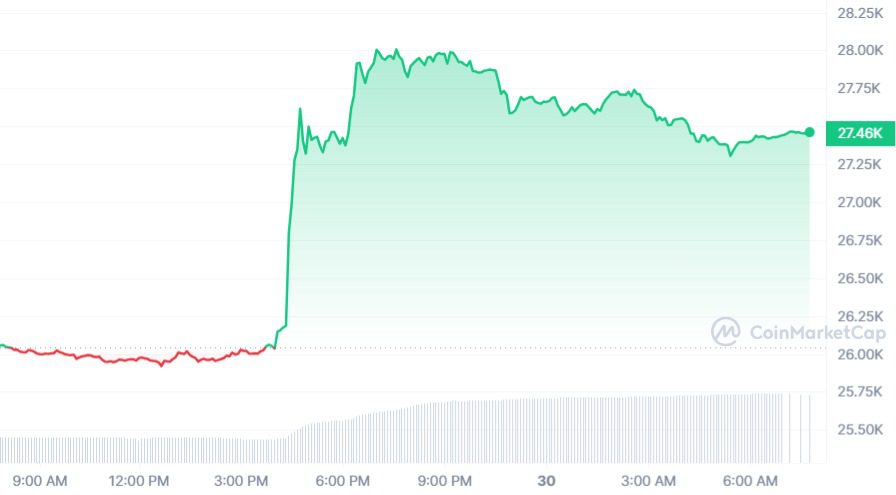

A new day is at the door. For the early risers among us, here’s a quick rundown of Bitcoin (BTC) price, last night’s top crypto news, and the current state of affairs. Yesterday, bitcoin price shot up after Grayscale won its lawsuit against the US Securities and Exchange Commission (SEC). How exactly are we priced and what can you expect today?

Bitcoin rises and exits its range

The tight range between $25,800 and $26,200 was abandoned yesterday after a long time. The judge’s decision is a big step towards a place exchange traded funds (ETF) for Bitcoin and so the price reacted extremely positively.

As the news broke, Bitcoin shot up from the $26,000 resistance zone to the $28,000 resistance zone. This resulted in a slight rejection which has caused us to currently trade just below this level. At the time of writing, the price on crypto exchange Bybit is $27,458 and on Dutch Bitvavo, bitcoin price in euros is 25,268.

The previous resistance levels of $26,200 and $26,700 are now serving as key support levels. Above $28,000, $28,800 and $29,100 are the next stops that could trigger a potential rejection.

Benjamin Cowen also announced on X formerly known as Twitter that the 21 week Exponential moving average (EMA) and the 20-week simple moving average (SMA) lie at $27,600 and $28,200 respectively, thus serving as key resistance levels.

Note that #BTCThe 21W EMA is at $27.6k, while the 20W SMA is at $28.2k. This would be the area to keep an eye on when doing a backtest. pic.twitter.com/r5DbAKZ8Xb

— Benjamin Cowen (@intocryptoverse) August 29, 2023

Bitcoin Today: US Economic Data

The economic calendar shows that some important economic data from the US will be released again today.

First, at 2:30 p.m., the growth in gross domestic product (GDP) for the past quarter is read. GDP is the most common measure of economic activity and an important indicator of economic health.

Growth is expected to be 2.4 percent, which would mean the US Federal Reserve still has room to keep interest rates high.

At 4:00 p.m. the provisional house sales for the month of July follow. It measures the change in house contract activity and was developed as a leading indicator of house activity.

In addition, at 4:30 p.m., crude oil inventories will be released. Inventory levels affect the price of oil products, which in turn affects inflation and other economic forces.

The most important crypto news from yesterday

Some important news came out late yesterday afternoon. Here we list the news not to be missed.

First, Grayscale’s legal victory over the SEC is not to be overlooked. According to the US judges, the SEC did not adequately explain why it rejected Grayscale’s earlier spot ETF application. However, the ruling does not mean the US can prepare for a spot Bitcoin ETF.

The second big news comes from X, formerly known as Twitter, which has been granted a license to offer crypto payments and commerce services in the US. You can read more about this later today on Crypto Insiders.