After one of the worst quarters for bitcoin (BTC) ever, cryptocurrencies seem to be able to catch their breath. In any case, the hard decline seems to be abating if we look at the sentiment in the market.

Bitcoin Fear and Greed Rises

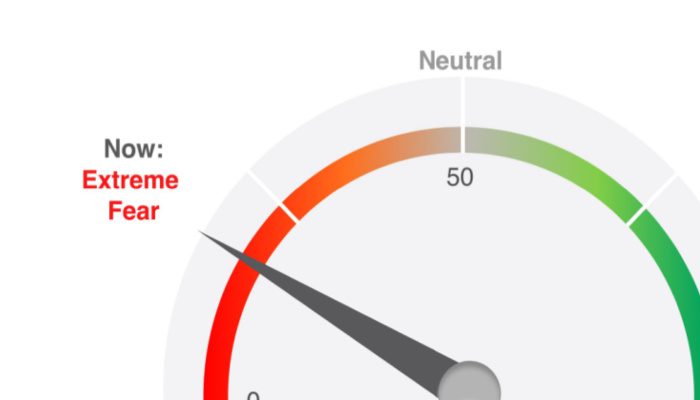

The Bitcoin Fear and Greed Index showed a score of 20 on July 8, which is the highest score we have seen in the past two months according to alternative.me† The last time we saw this level was on May 7.

According to a report published by Arcane Research on July 5, the indicator is creeping closer to the ‘fear’ level. This is good news as we have been in extreme fear for a very long time.

How does Bitcoin Fear and Greed work?

The Fear and Greed model is a model based on six different aspects that reflects market sentiment. The six factors are: volatility (25%), market momentum/volume (25%), social media (15%), surveys & market research (15%), bitcoin dominance (10%) and finally trends measured by Google (10 %).

This model analyzes these aspects on a daily basis and compares the outcome with the day before. Here comes a certain number. This figure represents whether traders are overly optimistic (greed) or extremely anxious (fear†

The fact that this model indicated that the market has been on extreme fear for so long is of course not surprising. Recently, we saw sharp declines and a lot of uncertainty in the market. This ensured that many investors no longer dared to buy or even dumped their position out of fear. That we have now risen from extreme fear to fear is already a relatively good sign.

Arcane Research has also indicated that bitcoin’s seven-day volatility is at its lowest point since the beginning of April. However, 30-day volatility still remains high.