The US authorities suddenly go full throttle after the stablecoin industry and that shakes several parties. What about, for example, the SEC’s ban on Paxos from issuing new Binance USD (BUSD) stablecoins. According to the US regulator, BUSD qualifies as an unregistered security under financial law.

Tether benefits

For the time being, market leader Tether (USDT) in particular seems to benefit from the uncertainty that currently prevails in the world of stablecoins. Recently, the largest stablecoin in the market added $ 2.05 billion to its market cap. Since the news, USDT’s market value climbed to the current $70.45 billion.

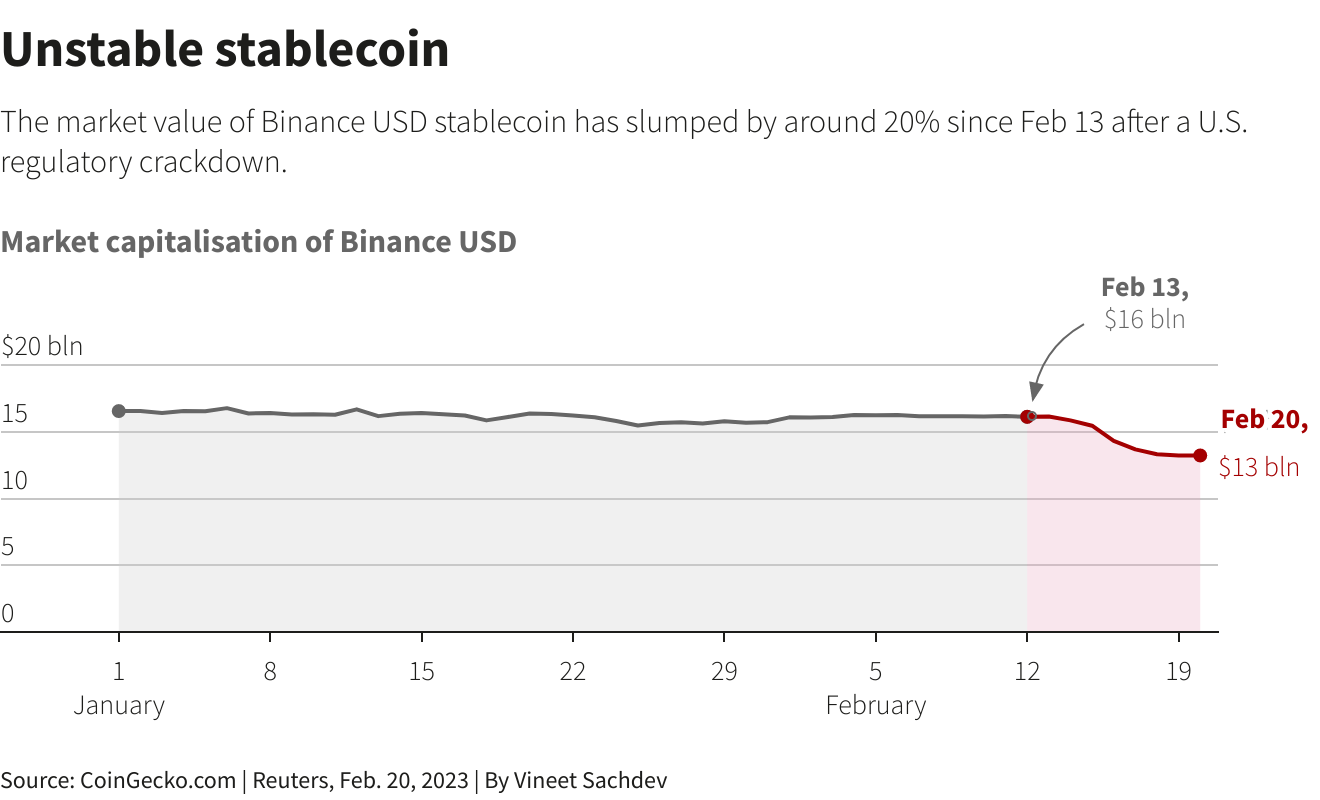

This puts it far ahead of its closest competitor USD Coin (USDC), which has a market capitalization of USD 49.49 billion. The Binance USD stablecoin from Paxos and Binance is doing less well, slipping from $16 billion to the current $12.69 billion.

As a result of these changes, Tether’s dominant position has grown to nearly 53 percent of the entire market. For all problems, this percentage was 51 percent. The number two Circle benefited a little bit and climbed to just over 31.3 percent of the market.

Bitcoin won’t budge

Despite all the problems in the market for stablecoins, which play an important role in the ecosystem, bitcoin (BTC) is not affected by all the commotion. In January, the largest currency in the market rose by almost 40 percent and the price will continue to rise steadily in February. The bulls have tried several times to break the $ 25,000 price, but have so far been rejected by the too strong bears.

The rest of the week seems to be dominated by the US economy again. On Wednesday, the Federal Reserve, the American central bank, publishes the FOMC minutes. These are the minutes of the most recent interest rate meeting of the most important central bank in the world.

Based on these minutes, we will probably learn more about the plans the Federal Reserve has for the coming period and which indicators they focus on for future interest rate decisions. Hopefully, this will provide the clarity the market needs to definitively choose a new direction.