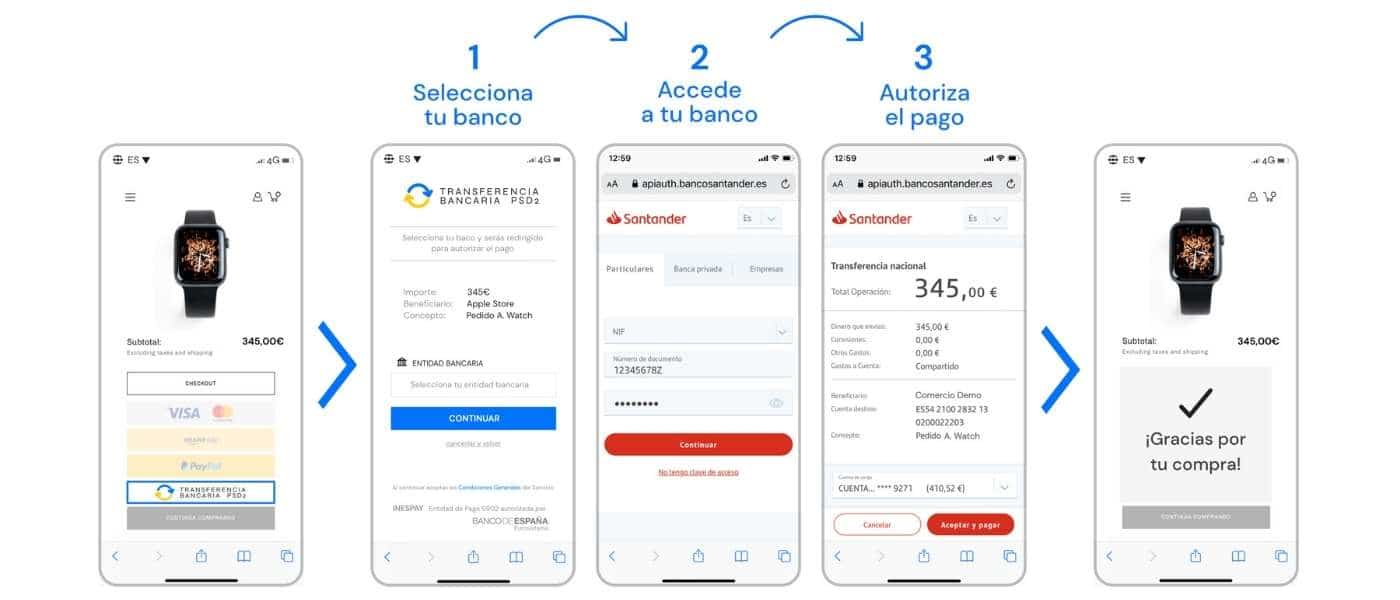

Now you can redirect your customer to your bank’s portal so that, in real time, they can authorize a bank transfer in three simple steps with their usual Online Banking passwords.

Paying by bank transfer is the most universal form of payment and inclusive: It does not require credit capacity or have a bank card or electronic wallet. Any banked consumer can use this means of payment. Usually, it is the preferred payment method to pay high amounts. In addition, it is the payment method that offers greater consumer safety by not needing to share payment information with anyone except your own bank. However, payment by conventional bank transfer in electronic commerce has drawbacks that are well known by professionals in the sector and also by consumers: It is tedious for both and lacks immediacy.

One of the most important novelties introduced by the second European Payment Services Directive (PSD2) is that it enables Payment Institutions licensed for the Payment Initiationdevelop a bank transfer payment service suitable, finally, for the business and consumer needs to pay online: Now it is possible redirect the consumer to their bank to authorize, in real time, a bank transfer using only your usual Online Banking passwords. No need for additional registrations.

The payment data such as the destination IBAN, the amount and payment concept are preset by trade and reported in real time to the issuing bank to process the payment and confirm its correct execution instantly, so that trade can confirm payment to the consumer in real time and proceed to the preparation of request without delay.

In short, the payment process by Bank Transfer PSD2 is integrated in the purchase flowproviding consumers and businesses with a payment method as satisfactory as those designed to pay online.

Use cases

Payment Initiation is ready to serve as a universal payment method in eCommerceboth in environments B2C as B2B. In the short term, it is called to replace the conventional online bank transfer and, in the medium term, it is expected that its adoption and use will increase in detriment of the cards banking. In the long term, its mission is to make the leap to physical point of salealthough it will largely depend, and in general terms, on the will of the banking industry.

Today, it is applicable to any online use case where necessary move funds from one bank account to another (eg eCommerce, transfer of funds, collection of deposits, top-up of balances, etc.). It is integrable in management programs such as ERPs or CRMs Y applicable to media such as email, SMS, electronic invoices or digital and even physical documents, through a request for payment in the form of a payment link or URL (Eg abandoned cart recovery, bill payment, collection, etc.). It is also very useful for reinforce processes KYC or KYB by obtaining irrefutable in each payment of the IBAN and Account Holder.

Additionally, it allows ordering and authorizing periodic transfers for subscription services with fixed amount. This service is an interesting alternative to direct debits or bank card charges, converting payments pull in payments push, thus eliminating the possibility of repudiation or return of direct debits.

Irrevocability of operations

One of the great advantages of this payment system compared to the traditional online bank transfer is that, payments initiated via PSD2 Bank Transfer in Spain and Portugal, whether initiated through the conventional SEPA scheme (n+1) or the instant SEPA schemethey are not cancelable by the user. Therefore, when the business receives the OK of the operation in real time, it has the certainty that the funds will be paid in your bank account, regardless of the SEPA scheme used.

The payment method with the greatest potential

There are many voices in the payment industry that predict a high growth and adoption of account-to-account payments for the next few years. After all, Payment Initiation has been promoted by the European Parliament and regulated in the Payment Services Directive to encourage innovation and boost Europe’s sovereignty in the means of payment industry.

With the aim of achieving a disintermediation In digital payments, payment initiation provides a reduction of time, processes and costs through direct transfers from bank to bank, using the secure interbank infrastructurethe SEPA payment schemes and their corresponding clearing and settlement chambers.

PSD2 and the regulatory technical standard (RTS) provide the necessary basis for the Initiation of Payments to prosper. However, there are more than 4,000 banking entities in Europe and this fact causes a lack of harmonization by banking in technology, functionality, processes and user experience. For example, not in all European countries there is certainty or irrevocability in the payment. In this sense, the instant SEPA scheme solve this problem. However, unfortunately, the vast majority of banks apply premium commissions to the user for the use of the instantaneous scheme and it does not seem that this situation is going to change in the short term.

Requires specialization at the national level

The operation of the Payment Initiation Service and its adaptation to the needs of digital payments on the Internet, requires a high specialization at the national level in the banking processes available through PSD2, in addition to complementing it with accessory technology services.

In INESPAY We concentrate all our efforts on being the referent in Initiation of Payments in Spain and Portugal. After years of work and collaboration with the actors involved, we are privileged to have become outstanding leader of the region. Thanks also to a easy integration of the service and some rates lower than those offered in purchasing services with bank cards, INESPAY already processes payments for a value greater than those €500 million per year a via PSD2 Bank Transfer and, with the growth trend that we observe, we trust exceed €2,000 million processed during the year 2023.

It would not have been possible to get here without the trust placed in INESPAY by our clients: PSD2 Bank Transfer INESPAY is already offered as a payment option by large businesses such as PcComponentes, Decathlon or Carrefour Viajes, in addition to other relevant platforms from different sectors and use cases such as travel agencies, airline consolidators, B2B wholesale distributors, collection agencies, billing platforms, public bodies or wealth managers, among others.