Bitcoin price continues to struggle due to the macroeconomic uncertainty currently prevailing worldwide. While the American economy remains surprisingly solid, there appears to be a recession in Germany, a gigantic real estate crisis underway in China and the Bank of England also appears to have reached the end of its interest rate campaign. Despite all the fireworks, prices remain somewhat stable overall, but it doesn’t look like much bullish out of.

Meanwhile, we see central bankers cautiously declaring “victory” over inflation, but what does this mean for Bitcoin?

The fight against inflation

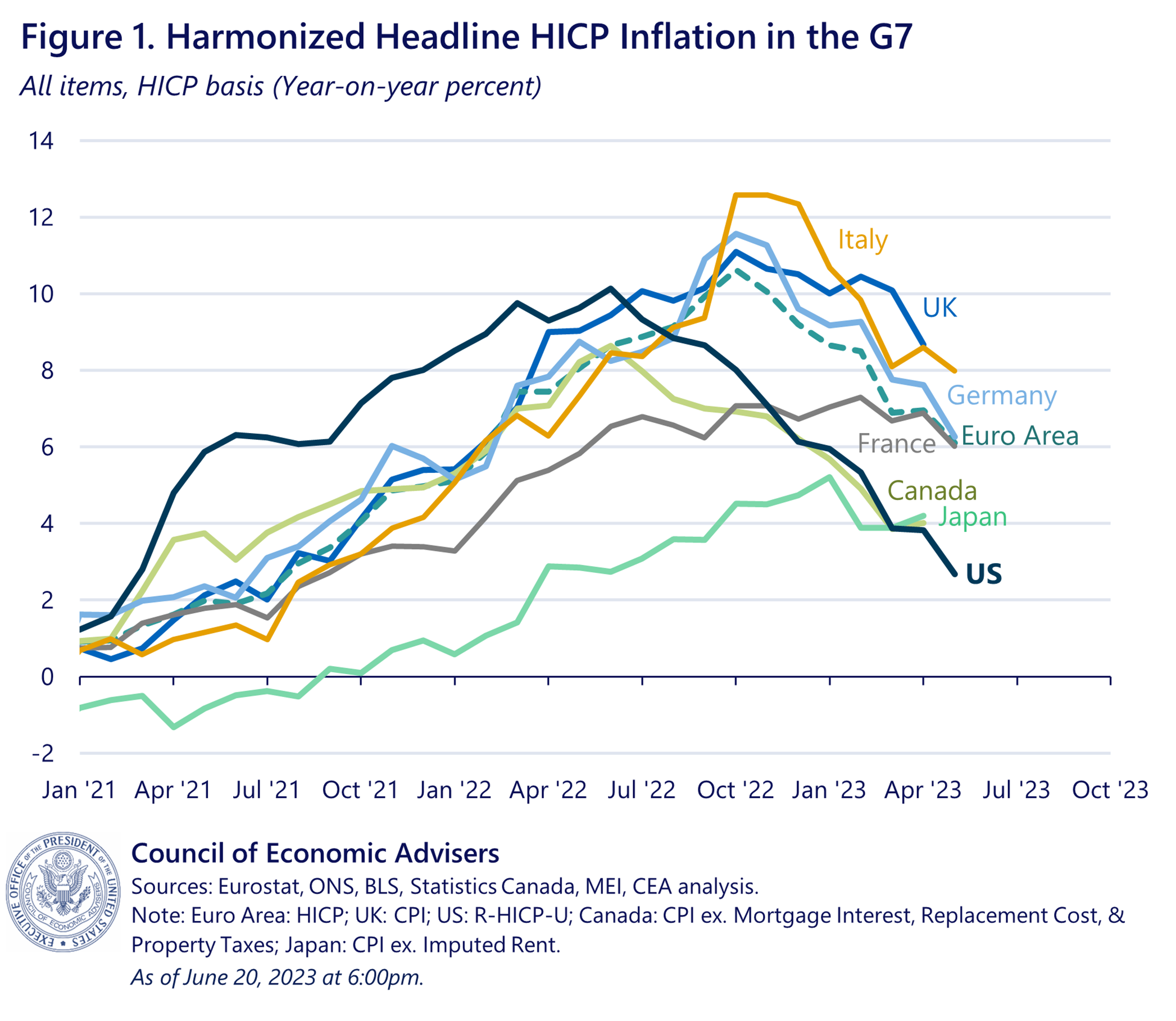

The central banks’ interest rate hikes, of course, began due to high inflation, which had to be tamed in some way. There is little other option for central banks than to raise interest rates to make capital more expensive and cause the economic machinery to slow down. Only in America does this economic machine still seem to be quite strong.

Nevertheless, this week we saw a number of Federal Reserve policymakers appear in the media with cautious “victory speeches” about the fight against inflation. Williams says the Federal Reserve remains data-dependent, but Logan says he’s open to a new rate pause in September (with possibly another rate hike at a later date).

In this respect, they seem to be slowly but surely approaching the end of the interest rate hike cycle, but they don’t dare to admit this 100 percent yet. There was also positive news about this from England; there Governor Macklem declared victory over inflation.

What does this mean for the Bitcoin price?

What exactly this means for the Bitcoin price is difficult to say because there are so many different things mixed up. On the whole, however, it appears that the US economy is king at the moment; while the rest of the world has it more difficult.

This likely means that the Federal Reserve, the US central bank, has more leeway to continue its tough anti-inflation policies. The market seems to share this view as the US dollar has risen sharply in recent weeks.

Bitcoin price, on the other hand, continues to struggle as interest rates in America (despite a possible pause) may remain at these elevated levels for a relatively long time due to the strong economy.

These developments appear to be particularly positive for the US dollar and the environment for risk assets remains uncertain for the time being.