According to CNBC’s report, strategists at Citibank are currently warning of a US recession (aka “hard landing”); As persistent wage and price inflation calls for tougher Federal Reserve policy. Of course, by tighter policy we mean that interest rates stay elevated longer, which Citi says should ultimately result in a significant slowdown in economic activity.

But what does Citi’s analysis mean for the Bitcoin price?

recession or no recession

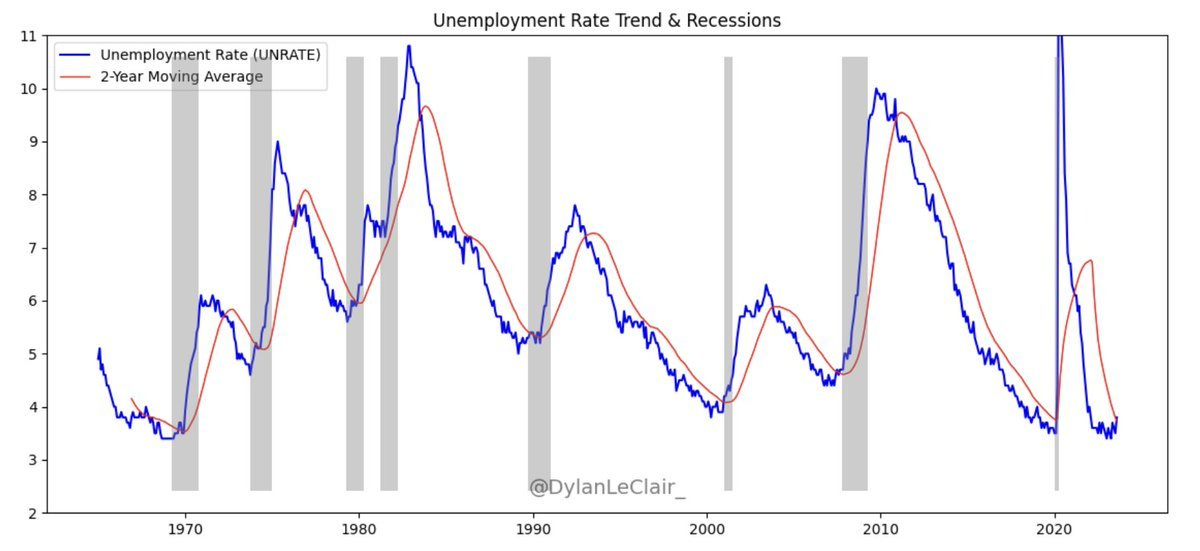

Opinions are still very divided on the question of recession. So far, the US economy has held up very well. Unemployment rose unexpectedly last week from 3.5 to 3.8 percent; However, this indicator is still at its lowest level for around 50 years.

As you can see in the chart above, unemployment is always relatively low just before a recession begins. Recessions are represented by the gray areas, while the blue line represents unemployment.

The timing of recessions and major reversals is often difficult to pinpoint. By and large, it is possible to make predictions, but the exact timing of when a recession will begin is nearly impossible to predict.

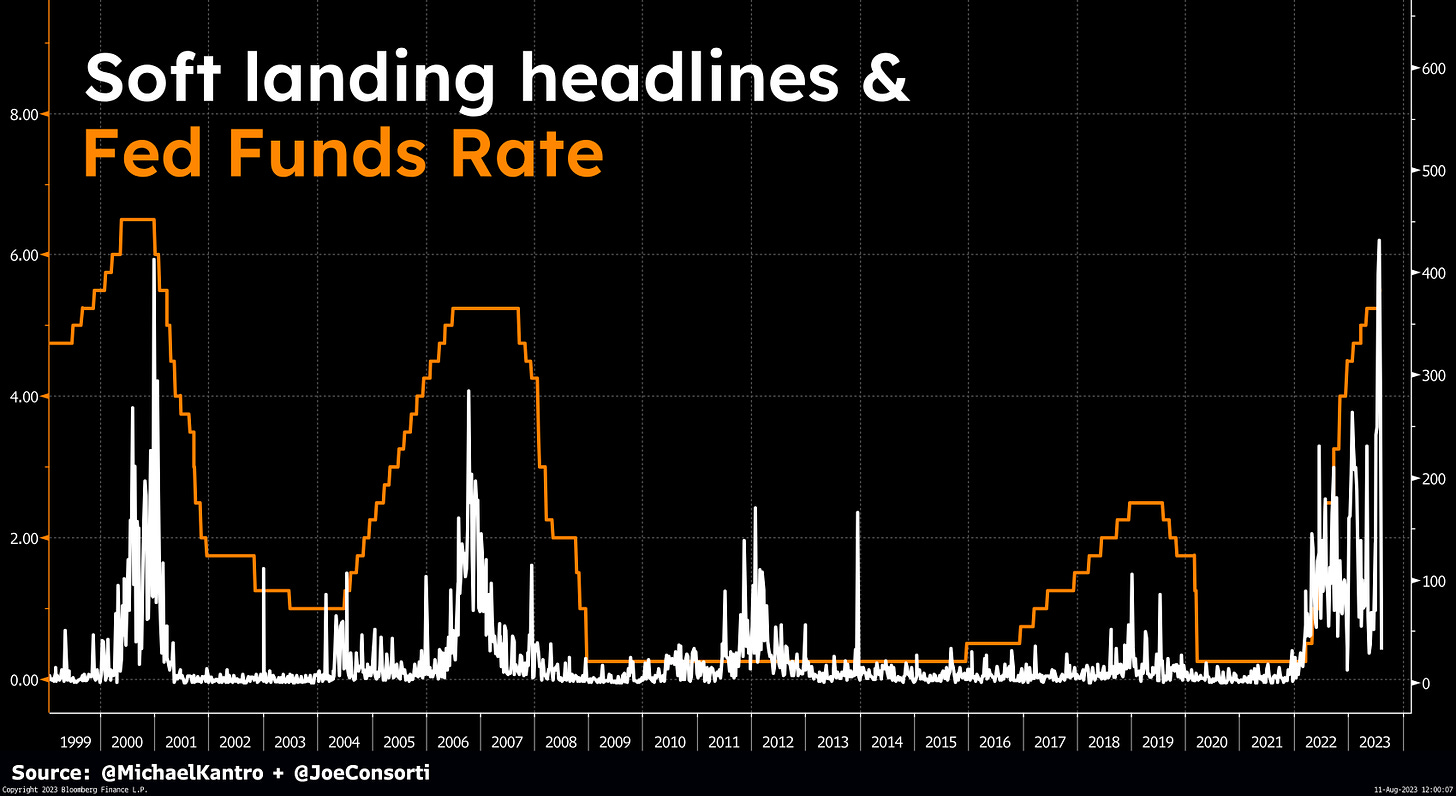

Interestingly, the number of ‘soft landing/no recession’ headlines is now peaking; which in the past were mostly associated with the onset of a recession. In the world of finance, things often happen when you least expect them.

What does this mean for the Bitcoin price?

Bitcoin price has been in a kind of limbo or gray zone for a while due to macroeconomic conditions. The difficult part is that all the scenarios that currently seem possible are a bit bearish for bitcoin. If we don’t see a recession, interest rates are likely to stay elevated longer to bring inflation back to 2.0 percent.

In this scenario, the economy remains stable, allowing American consumers to keep their jobs and spend; which keeps inflationary pressures high. That’s the scenario Citibank is talking about.

If there is a recession, unemployment will skyrocket and people will likely need to sell their investments for US dollars to gain some financial security.

It is not for nothing that during a recession we often see the prices of risky assets (Bitcoin and stocks) rising. People then build up some security by exchanging their wealth for dollars; because they can use it to pay their bills.