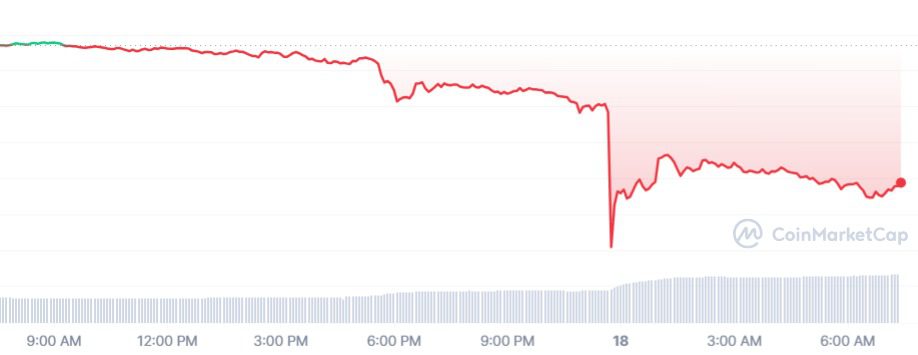

Bitcoin price has fallen sharply since last night. The fear is widespread and likely related to a number of things, including the new developments that emerged last night. In this article you can read the current state of affairs.

Bitcoin price plunges to its lowest level in months

Yesterday it was read that Bitcoin had already fallen and the price was above a crucial price point at this point. So BTC still failed.

That key price point was $28,500, marking the bottom of the price range Bitcoin has been in since late July. When the price broke through here, things happened very quickly.

The bottom of the quick correction was $25,230. This is the lowest price since mid-June. The positive price action that began in late June as a result of BlackRock’s bitcoin exchange fund filing has now completely reversed.

After the correction, Bitcoin recovered slightly. BTC is now worth $26,480 on crypto exchange Bybit. On the Dutch crypto exchange Bitvavo, the Bitcoin-Euro price is now at €24,370.

Why is bitcoin falling?

Why the bitcoin price is currently declining is a question that cannot be answered conclusively. However, there are a number of developments that, taken together, make for a frightening market situation.

First, SpaceX, Elon Musk’s aerospace company, has reportedly sold $373 million worth of Bitcoin, the Wall Street Journal writes. However, this news has not yet been officially confirmed.

We can’t confirm reports that SpaceX made $373 million in revenue #Bitcoin

The WSJ’s report is unclear, stating, “SpaceX wrote down the value of.” #Bitcoin it owns a total of $373 million and has sold the cryptocurrency over the last year and 2021.”

Currently there is no… pic.twitter.com/75EcdLzBzS

— Watcher.Guru (@WatcherGuru) August 17, 2023

Crypto Insiders also reported yesterday that the US Federal Reserve is still afraid of inflation. There is therefore a possibility that interest rates will be raised even further. You can read more about the potential impact on Bitcoin in this article.

Finally, data from Coinglass shows that futures traders have been particularly hard hit. A whopping $835 million was paid in the last 24 hours lung Contracts liquidated.

This means that traders who were expecting a rise (long) were forced to close their positions. The liquidation of long positions creates additional selling pressure in the markets.