The clock is ticking down on the current fiscal season. Players in this economic game, those needing to settle their 2024 income tax with the authorities, face a hard deadline today. These are the declarations made to the tax officials between April and June this year.

The official deadline for this particular payment was actually August 31st. But here’s a twist in the rulebook: when a deadline falls on a Sunday, the game gets an extra day. So, the cutoff moved to today, September 1st.

The fiscal management team had until July 31st to finalize the scorecards for all players. This covered everyone who submitted their income reports within the legal window, which ran from April 1st to June 30th. Simply put, they had until the end of July to check all the numbers and declare the income tax calculation complete.

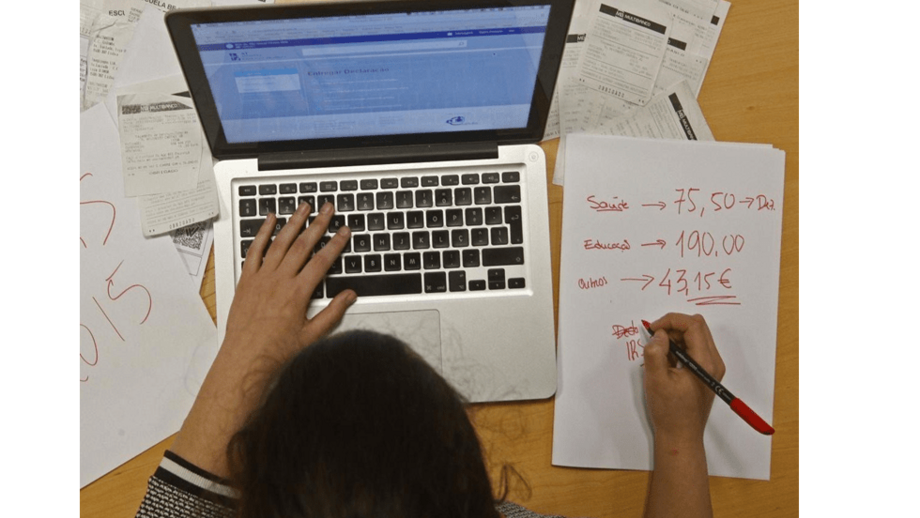

If the final score on the board showed that players still owed money, they were given a one-month window to make their payment to the officials. That crucial payment period now closes.

When the Tax and Customs Authority (AT) finishes tallying the income tax, the final calculation can swing two ways. It might mean a collection, where players are asked to deliver missing tax amounts. Or, it could result in a refund, which is the opposite – citizens get money back because the tax adjustment demands it.

Having to pay up in this final stage doesn’t necessarily mean you’re paying more tax than last year. It simply means the amount of tax already held by the state didn’t quite match the real income tax total for the player. This final score depends on the effective tax rate applied to their specific financial situation, which is linked to their annual income level.

When calculating the final income tax, the AT considers what a player already paid to the tax officials throughout the previous year through withholdings. If the final income tax amount is higher than what was already advanced over those twelve months, the AT sends a collection notice. This note clearly states how much is due now.

Before reaching that final figure, the AT also considers deductions when calculating income tax. These deductions can significantly influence whether a player receives a refund or has to make a payment at this stage of the game.

Beyond the payment deadline for players, the Tax Authority also has its own clock ticking. They must finish sending out all refunds to players who filed their declarations by the legal deadline at the end of June. If they fail to do so, they will owe that money back, plus interest.