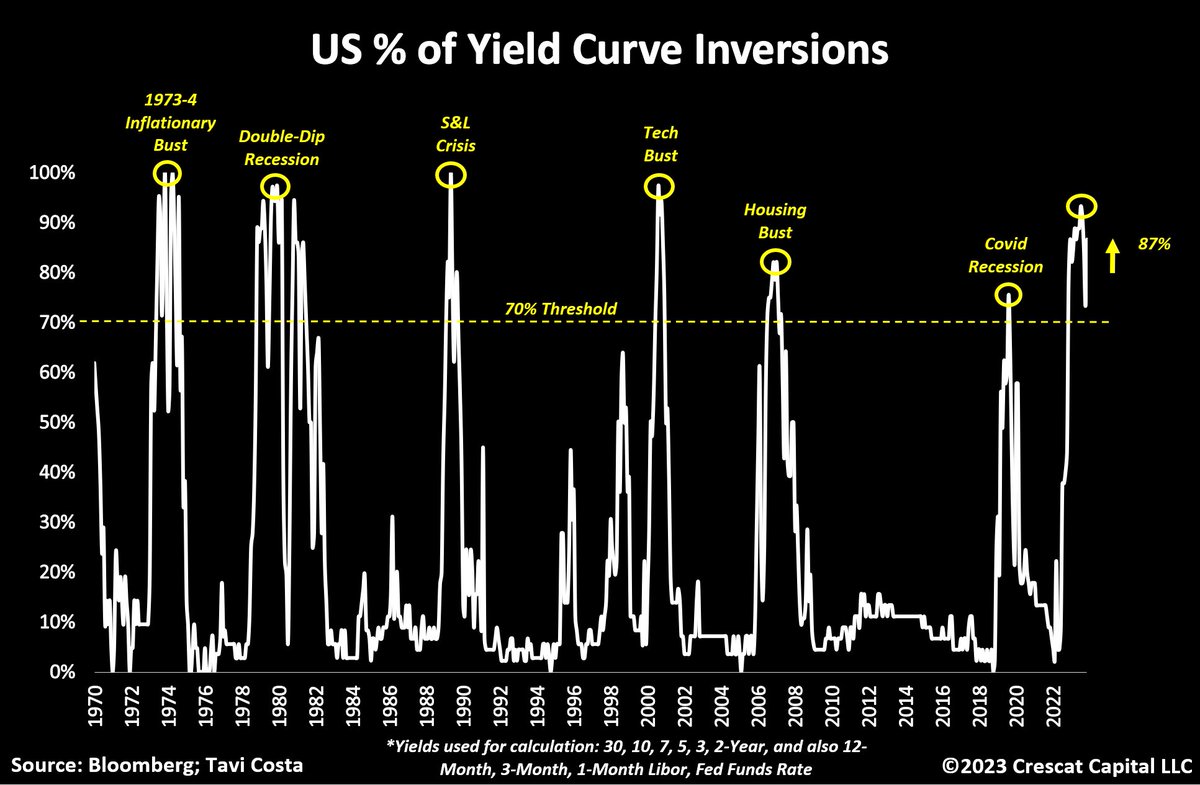

Although Bitcoin (BTC) is rising again, there are still concerns about an impending recession. The bond market continues to scream for a recession and the chart below is an important reminder of that.

There is currently an inverted yield curve, meaning that interest rates on short-term US Treasury bonds are higher than on long-term versions. The following graphic shows that in the past this signal almost always preceded gigantic problems for the financial market.

Should we be worried about the Bitcoin price? So far that one cops Ignore this signal and the price will continue to rise.

🎁 This week: Trade your first €10,000 in crypto completely free

Is another economic recession imminent?

Of course, the fact that we haven’t had a recession yet doesn’t mean that the possibility of an economic downturn is now completely off the table. Almost 90 percent of the US yield curve is still inverted.

This happens when investors buy long-term government bonds en masse and the interest rates on these instruments fall below the interest rates on short-term government bonds.

Why do investors buy long-term government bonds en masse? They typically do this because they expect the Federal Reserve to cut interest rates in the short term. Since inflation has not yet disappeared, almost only a recession can be a reason for a rate cut.

This is why an inverted yield curve has been a highly reliable indicator of recessions over the past 60 years or so. What is interesting is that recessions often only begin when the yield curve returns to “normal”; which means the reversal is over.

Should we be worried about the Bitcoin price?

The Bitcoin price is currently developing strongly. Any correction we see is bought up very quickly, and that is generally a sign that the uptrend is not over yet.

The increases we are currently seeing appear to be driven by the possible launch of a spot Bitcoin ETF or exchange fund, which is expected to launch in the US in early 2024. The market hopes that such an exchange fund can attract massive amounts of capital, especially from the institutional sector.

We will also get a new Bitcoin in 2024 halving and interest rates are expected to fall again in the long term.

The only danger? So this is the recession that is still in the air according to various indicators. A recession is never certain, but we cannot completely rule it out. Therefore, it is advisable to be careful and monitor the situation closely. The chart below from Bank of America shows that a recession is usually not a party for the stock market. This will most likely be no different with Bitcoin.

Post views: 449