In this article, we discuss the price of Polygon (MATIC), a platform that improves the scalability of the Ethereum blockchain by enabling faster and cheaper transactions. This analysis from the premium environment provides insight into MATIC’s recent price movements and the expected trend for the near future.

For a more in-depth analysis, consider a 30-day trial in our Premium environment for just €1.

New entry opportunities for Polygon (MATIC)

The world of cryptocurrencies is constantly changing and prices fall as often as they rise. Don’t worry: Even if the value of a cryptocurrency falls, new profit opportunities arise. Our experts believe that MATIC could soon experience a decline and create a new entry point. Read on for the latest analysis from our experts:

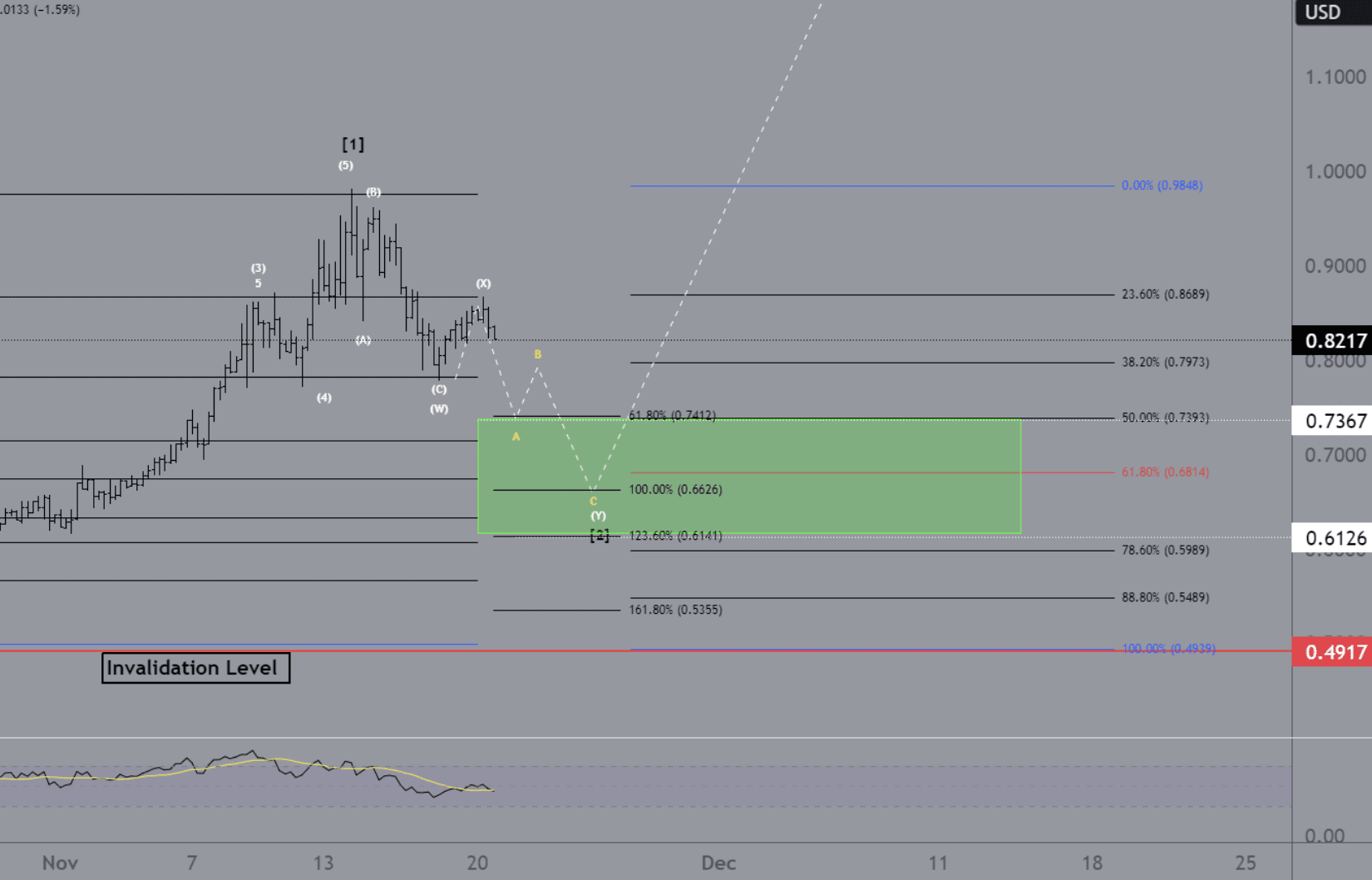

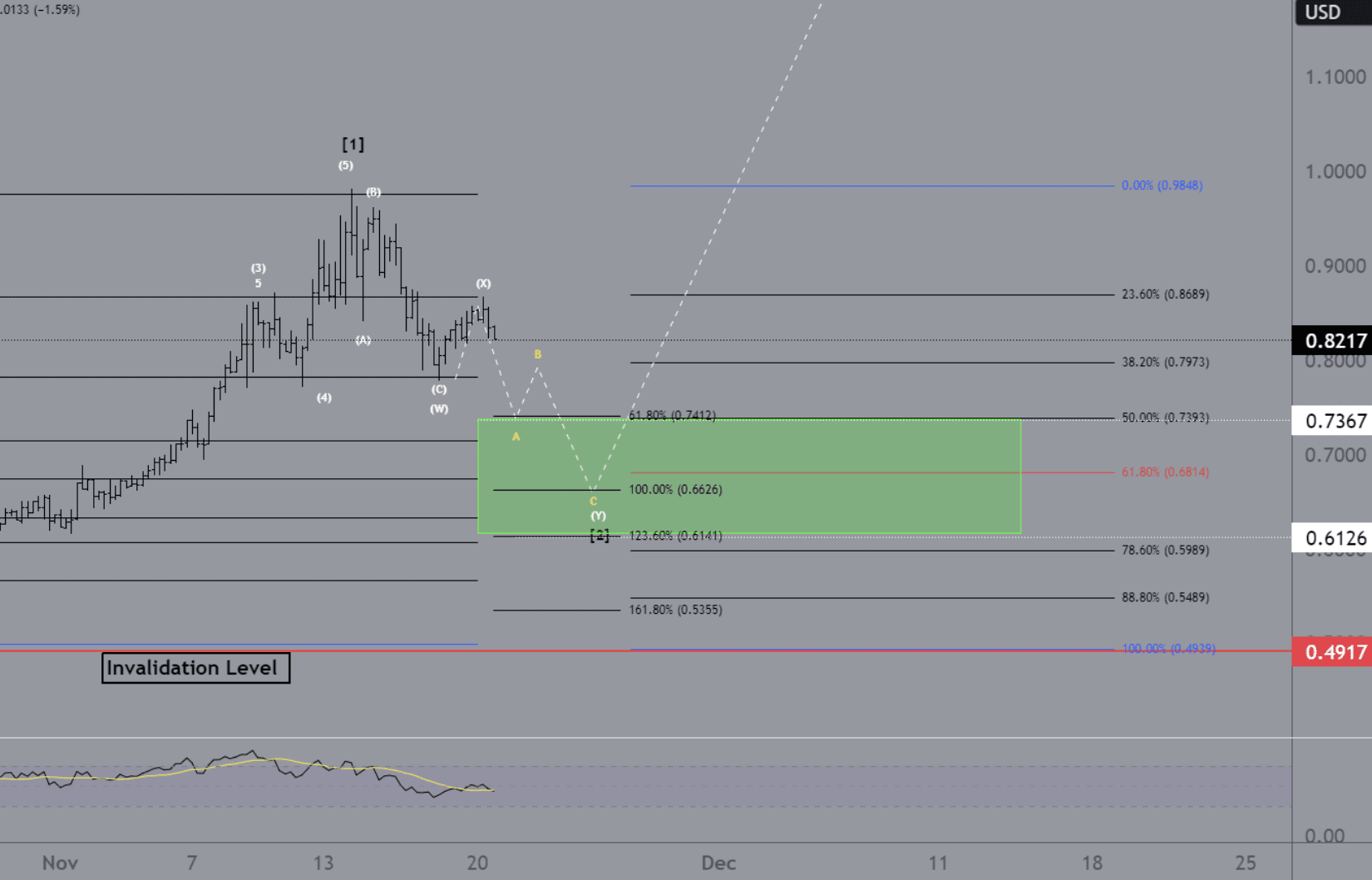

“Our polygon analysis shows a downtrend forming as a descending WXY Elliott wave pattern, part of the larger second wave of a 12345 Elliott wave pattern.

Interestingly, wave 1 reached our target around the $1 zone, which now turns our attention to the green buy zone between $0.61 and $0.74.

Within this zone, we would like to consider buying MATIC with the expectation of an upward move. This increase should start around 100% Fibonacci, where the WXY-EW pattern is expected to end at around $0.66.

An important point to keep in mind is the invalidation level at $0.49. A fall below this level would force us to rethink our strategy.”

Follow the top crypto traders in the Netherlands

In our premium environment you will find our extensive trading plan with the latest updates. As a Premium Member, you enter a safe place where traders of all experience levels share knowledge. Ask experienced analysts and top traders about trading, market trends and crypto topics in a lively community. We also organize weekly live streams and webinars for traders who want to delve deeper into technical analysis.

Disclaimer: Investing involves risks. Our analysts are not financial advisors. Always consult an advisor when making financial decisions. The information and tips provided on this website are based on our analysts’ own insights and experiences. These therefore serve exclusively educational purposes